Genuine Parts Company, a leading global service provider of automotive and industrial replacement parts and value-added solutions, announced today its results for the first quarter ended March 31, 2025.

“We had a solid start to 2025, despite the tariffs and trade dynamics that are impacting the operating landscape,” said Will Stengel, President and Chief Executive Officer.

“We remain focused on what we can control—excellent customer service and our strategic initiatives to improve the business. I am proud of our teammates across the globe and want to thank them for their dedication to serving our customers.”

First Quarter 2025 Results

Sales were $5.9 billion, a 1.4% increase compared to $5.8 billion in the same period of the prior year. The improvement is attributable to a 3.0% benefit from acquisitions, partially offset by a 0.8% decrease in comparable sales and a 0.8% net unfavorable impact of foreign currency and other. The first quarter included one less selling day in the U.S. versus the same period of the prior year, which negatively impacted sales growth and comparable sales growth by approximately 1.1%.

All figures in USD.

Net income was $194 million, or $1.40 per diluted earnings per share. This compares to net income of $249 million, or $1.78 per diluted share in the prior year period.

Adjusted net income was $243 million, or $1.75 per diluted earnings per share. Adjusted net income excludes a net expense of $49 million after tax adjustments, or $0.35 per diluted share, which relates to costs associated with the company’s global restructuring initiative and the ongoing integration of acquired independent automotive stores.

This compares to adjusted net income of $311 million, or $2.22 per diluted share in the prior year period. Refer to the reconciliation of GAAP net income to adjusted net income and GAAP diluted earnings per share to adjusted diluted earnings per share for more information.

First Quarter 2025 Segment Highlights

Automotive Parts Group

Global Automotive sales were $3.7 billion, up 2.5% from the same period in 2024. The improvement is attributable to a 4.1% benefit from acquisitions, partially offset by 0.8% decrease in comparable sales and a 0.8% net unfavorable impact of foreign currency and other. The one less selling day in the U.S. compared to the prior year period negatively impacted Global Automotive sales growth and comparable sales growth by approximately 0.9%. Segment EBITDA of $286 million decreased 10.7%, with segment EBITDA margin of 7.8%, down 110 basis points from the same period of the prior year.

Industrial Parts Group

Industrial sales were $2.2 billion, down 0.4% from the same period in 2024, with a 1.3% benefit from acquisitions, offset by a 0.7% decrease in comparable sales and 1.0% unfavorable impact of foreign currency. The one less selling day in the U.S. compared to the prior year period negatively impacted Global Industrial sales growth and comparable sales growth by approximately 1.5%. Segment EBITDA was in-line with the prior year period at $279 million, with segment EBITDA margin of 12.7%, up 10 basis points from the same period of the prior year.

Balance Sheet, Cash Flow and Capital Allocation

The company’s cash flow from operations decreased $41 million for the first three months of 2025 mostly due to lower net income and working capital changes primarily driven by seasonal sales and purchasing trends. Net cash used in investing activities was $155 million, including $120 million for capital expenditures and $74 million for acquisitions. Net cash provided by financing activities was $129 million, including $772 million in net proceeds of commercial paper, partially offset by $134 million for quarterly dividends paid to shareholders. Free cash flow decreased $161 million for the first three months of 2025. Refer to the reconciliation of GAAP net cash provided by operating activities to free cash flow for more information.

As of March 31, 2025, the company had $420 million in cash and cash equivalents, as well as $2 billion in undrawn capacity on the company’s Revolving Credit Agreement, before giving effect to commercial paper borrowings.

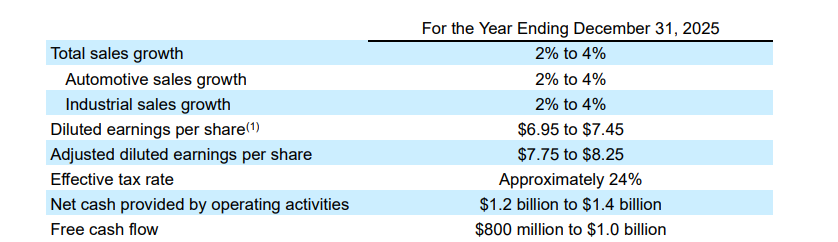

2025 Outlook

The company is reaffirming full-year 2025 guidance previously provided in its earnings release on February 18, 2025. The company considered its recent business trends and financial results, current growth plans, strategic initiatives, global economic outlook, geopolitical conflicts and the potential impact on results in updating its guidance, which is outlined in the table below.

The outlook below does not include impacts from new U.S. tariffs announced in the first quarter or any reciprocal tariffs, which are inherently difficult to predict given the high level of uncertainty regarding trade negotiations and responses that may occur in the future.

In addition, the outlook does not include the previously announced one-time, non-cash charge the company expects to record when its U.S. pension plan termination settles (which is expected to occur in late 2025 or in early 2026). This one-time, non-cash charge is not included in the 2025 outlook due to the uncertainty regarding when the termination of the plan will ultimately settle. However, to the extent the one-time, non-cash charge is recognized in 2025, diluted earnings per share in the table below will be impacted. The one-time, non-cash charge will not impact adjusted diluted earnings per share.

Conference Call

Genuine Parts Company held a conference call today at 8:30 a.m. Eastern Time to discuss the results of the quarter. A supplemental earnings deck will also be available for reference. Interested parties may listen to the call and view the supplemental earnings deck on the company’s investor relations website. The call is also available by dialing 800-836-8184. A replay of the call will be available on the company’s website or toll-free at 888-660-6345, conference ID 30546#, two hours after the completion of the call.

0 Comments