O’Reilly Automotive, Inc., a leading retailer in the automotive aftermarket and owner of Goupe Del Vasto in Canada, announced record revenue and earnings for its third quarter ended September 30, 2024.

Brad Beckham, O’Reilly’s CEO, commented, “Our comparable store sales increased 1.5% in the third quarter, as we faced broad-based consumer pressures and a soft demand environment on both the professional and DIY sides of our business. While our third quarter results were below our expectations, we are pleased with our team’s unwavering dedication to our customers and their ability to still deliver positive comparable store sales results in tough conditions, on top of the robust 8.7% and 7.6% increases we generated in the third quarter the last two years.

“We are also pleased to have generated another strong quarter of sales growth in our professional business, where we continue to gain market share. We remain very confident in the strength of the long-term, core drivers of demand in our industry, as well as our team’s ability to outpace the market. I would like to express my appreciation to our over 92,000 team members for their unrelenting hard work and commitment to providing industry-leading service to our customers.”

Sales for the third quarter ended September 30, 2024, increased $161 million, or 4%, to $4.36 billion from $4.20 billion for the same period one year ago. Gross profit for the third quarter increased 4% to $2.25 billion (or 51.6% of sales) from $2.16 billion (or 51.4% of sales) for the same period one year ago.

All figures in USD.

Selling, general and administrative expenses for the third quarter increased 7% to $1.35 billion (or 31.0% of sales) from $1.26 billion (or 30.1% of sales) for the same period one year ago. Operating income for the third quarter was $897 million (or 20.5% of sales), which was flat compared to $897 million (or 21.3% of sales) for the same period one year ago.

Net income for the third quarter ended September 30, 2024, increased $16 million, or 2%, to $665 million (or 15.2% of sales) from $650 million (or 15.5% of sales) for the same period one year ago.

Diluted earnings per common share for the third quarter increased 6% to $11.41 on 58 million shares versus $10.72 on 61 million shares for the same period one year ago.

Year-to-Date Financial Results

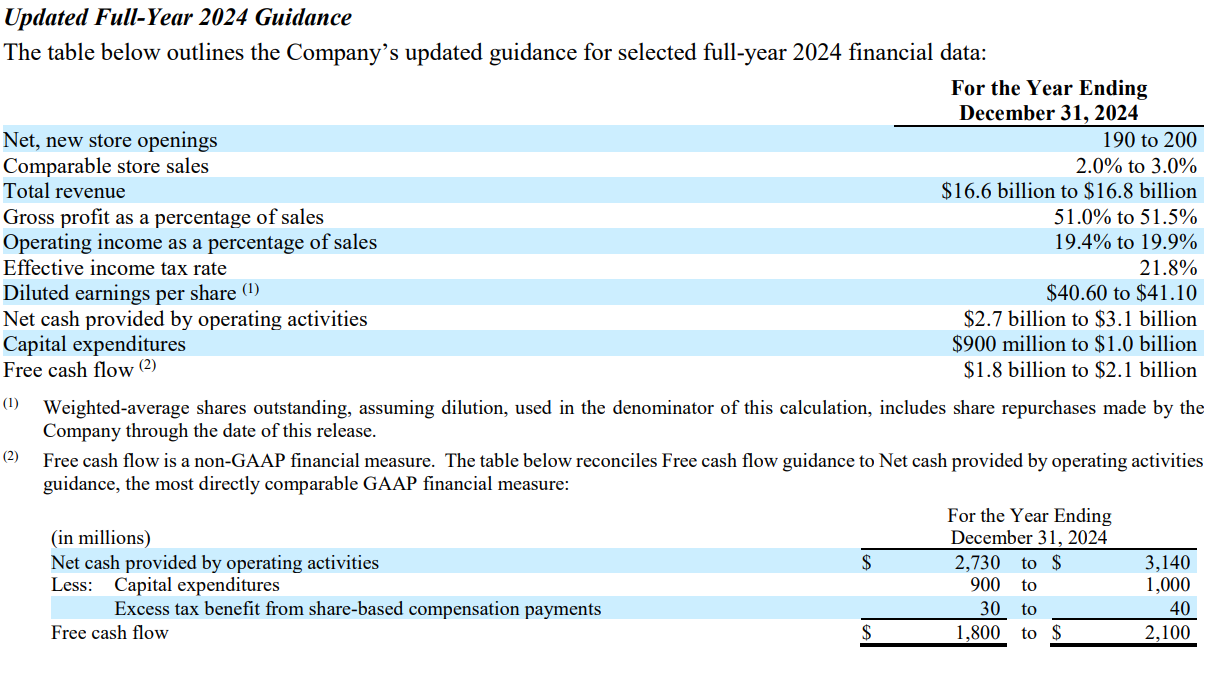

“We are tightening our full-year comparable store sales guidance from a range of 2.0% to 4.0% to a range of 2.0% to 3.0%, to reflect our performance so far this year and expectations for the remainder of 2024,” Beckham concluded.

“We remain very confident in Team O’Reilly and their ability to consistently execute our proven dual market strategy and gain market share by relentlessly focusing on providing the highest levels of service in the industry, supported by best-in-class parts availability.”

Sales for the first nine months of 2024 increased $633 million, or 5%, to $12.61 billion from $11.98 billion for the same period one year ago. Gross profit for the first nine months of 2024 increased 5% to $6.45 billion (or 51.2% of sales) from $6.14 billion (or 51.2% of sales) for the same period one year ago.

SG&A for the first nine months of 2024 increased 7% to $3.94 billion (or 31.2% of sales) from $3.67 billion (or 30.6% of sales) for the same period one year ago. Operating income for the first nine months of 2024 increased 2% to $2.51 billion (or 19.9% of sales) from $2.47 billion (or 20.6% of sales) for the same period one year ago.

Net income for the first nine months of 2024 increased $41 million, or 2%, to $1.84 billion (or 14.6% of sales) from $1.79 billion (or 15.0% of sales) for the same period one year ago. Diluted earnings per common share for the first nine months of 2024 increased 7% to $31.14 on 59 million shares versus $29.20 on 61 million shares for the same period one year ago.

3rd Quarter Comparable Store Sales Results

Comparable store sales are calculated based on the change in sales for U.S. stores open at least one year and exclude sales of specialty machinery, sales to independent parts stores, and sales to Team Members, as well as sales from Leap Day in the nine months ended September 30, 2024. Online sales for ship-to-home orders and pick-up-in-store orders for U.S. stores open at least one year are included in the comparable store sales calculation.

Comparable store sales increased 1.5% for the third quarter ended September 30, 2024, on top of 8.7% for the same period one year ago. Comparable store sales increased 2.4% for the nine months ended September 30, 2024, on top of 9.4% for the same period one year ago.

Share Repurchase Program

During the third quarter ended September 30, 2024, the Company repurchased 0.5 million shares of its common stock, at an average price per share of $1,084.28, for a total investment of $541 million. During the first nine months of 2024, the company repurchased 1.5 million shares of its common stock, at an average price per share of $1,038.32, for a total investment of $1.60 billion. Excise tax on shares repurchased, assessed at one percent of the fair market value of shares repurchased, was $16.0 million for the nine months ended September 30, 2024.

Subsequent to the end of the third quarter and through the date of this release, the company repurchased an additional 0.1 million shares of its common stock, at an average price per share of $1,170.55, for a total investment of $70 million.

The company has repurchased a total of 95.7 million shares of its common stock under its share repurchase program since the inception of the program in January of 2011 and through the date of this release, at an average price of $259.72, for a total aggregate investment of $24.85 billion. As of the date of this release, the Company had approximately $898 million remaining under its current share repurchase authorization.

Earnings Conference Call Information

The company will hosted a conference call on Thursday, October 24, 2024, at 10:00 a.m. Central Time to discuss its results

as well as future expectations. A replay of the conference call will be available on the company’s website through Thursday, October 23, 2025 on the Company’s website at www.OReillyAuto.com by clicking on “Investor Relations” and then “News Room.”

0 Comments