New car sales are a great indicator of a lot of things: consumer confidence, the related issue of consumers’ collective stomach for debt, the health of the economy at large, and, as we have learned over the pandemic, the ability of the automotive supply chain to deliver. For the aftermarket, the impact is, for the most part, less immediate, but still critically important to the long term health of the industry, but sometimes in unexpected ways.

A recent brief report from DesRosiers Automotive Consultants put a firm stamp of qualified positivity on the new car sales of 2024.

In its “2024 – A Respite from the Chaos?” the Canadian research firm asked rhetorically whether the decent new car sales results of 2024 were the continuation of a positive trend, or a calm before more chaos decends in 2025.

First the facts:

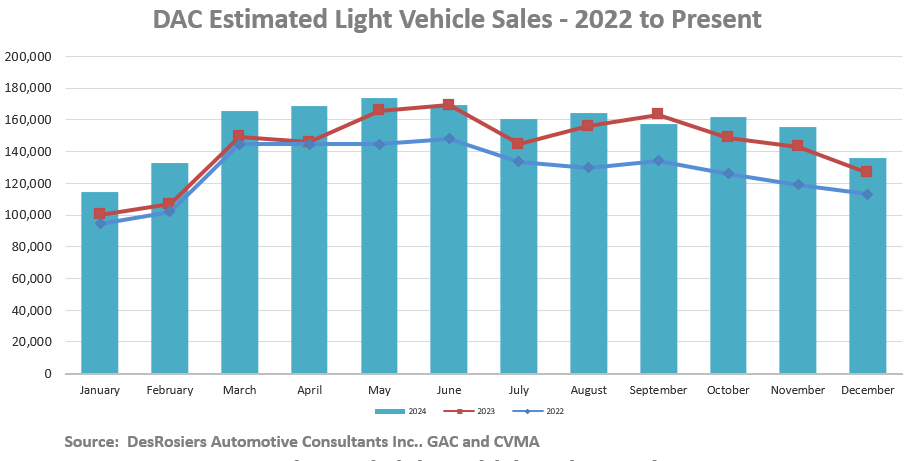

According to DAC, overall sales for the year reached an estimated 1.86 million, an increase of 8.2% from the 1.72 million units seen in 2023. Andrew King, Managing Partner of DAC commented “While we would never take a gain of 8.2% for granted, the market remains approximately 180 thousand units below its 2017 high, despite a Canadian population that has increased from 36.7 to 41.5 million people over that time.”

So there’s the good news/bad news story for the auto manufacturing segment: positive improvement in sales, but not keeping pace with population growth.

It should be noted that there was an anomaly thrown into the mix as a result of changes to Quebec’s EV subsidy program that saw consumers in La Belle Province rush to dealers to get ahead of the reduced incentives. Expect EV advocates to post about massive sales gains and project straight lines updward. Also, expect real sales not to match that prediction in 2025, made all he more sticky by the reduced incentives and a pause on incentives altogether in the province in February and March.

To be fair, 2024 was a year of boom and bust.

Exceptionally strong sales in January and February, says DAC, were the result of pent-up demand as supply was able to meet more of the consumer demand.

DAC did pick out key trends:

- The story in 2024 was compact and subcompact SUVs growth – the former dominating the market with sales rising to more than 560 thousand units

- Light truck/SUV share hit a new record, with passenger cars falling to only 13.4% of total sales

- The luxury market underperformed in 2024 as affordability issues came to the fore

- On the ZEV front there was a rush of Quebecers in Q4 to purchase ZEVs before incentives are cut, and the resurgence of PHEVs

DAC did note that sales throughout the year were notably less peaky; while May returned to its tradition place as the sales leader, the “remarkably flat,” sticking closely to the 165,000 mark, plus or minus 10,000 units.

Looking ahead DAC points to the unpredictable U.S. administration and the now certain Canadian election on the horizon.

For the aftermarket though, a consistent new car sales market is important. Vehicles in operation (VIO) are a key determinant in what is actually available to be fixed by aftermarket service facilities.

While not at the 2017 high watermark of a bit over 2 million, it is notable that staying above 1.6 million units per year (2024 was at 1.86 million) means that the overall car par might have grown, but it’s not a certainty

According to information posted by the Automotive Recyclers of Canada, about 1.6 million vehicles are scrapped each year in Canada. Certainly new car sales surpassed the level. And it’s possible scrappage rates are dropping, as evidenced by vehicle on the road again.

One factor that could have a negative effect on the vehicle population in Canada is cross-border commerce. This is not new, but is an often overlooked dynamic in the vehicle sales market.

In his presentation at the AIA Canada National Conference in April, 2024, Todd Campau, S&P Global Mobility’s Automotive Aftermarket Practice Lead, said that while the steady state of used vehicles crossing the border to the U.S. is less than 100,000 a quarter, this spiked at points during the pandemic, fueled by shortages of used vehicles in the U.S. and advantageous exchange rates.

“Prior to the pandemic, it was less than a hundred thousand a quarter, or about 300,000 a year. The pandemic shot that up; there’s a couple quarters that were almost 200,000 a quarter. That’s pretty significant. That’s about 1% of your fleet leaving per quarter and that’s why your VIO number was [actually down].”

With exchanges rates currently advantageous for U.S. buyers, it would not come as a surprise if the pull of that opportunity results in a dip in Canada’s vehicle population, despite that rising sales figures at the new car end of the spectrum.

It all points to a need to drive demand to aftermarket facilities, not just wait for it to happen.

0 Comments